What worked in the post-global financial meltdown era of 2008-2014 will not work the same magic in the next seven years.

I am often amused by the Western media's readiness to attribute godlike powers of long-term planning and Sun-Tzu-like strategic brilliance to China's leadership. A well-known anecdote illustrates the point.

Zhou Enlai, Premier of China in the Mao era, who when asked by Henry Kissinger about the French Revolution, is reputed to have replied, "It's too early to say."

This is generally taken to express the Chinese Long View, i.e. that the events of 1789 are still playing out.

But accounts of those present discount this interpretation. Zhou understood Kissinger's query as being about the 1968 general strike in France. That social revolution was still actively in play in the early 1970s when Zhou and Kissinger were meeting, so the time frame was definitely present-day, not the 18th century.

China's dramatic rise since the early 1980s, when Deng Xiaoping's reforms occurred, has been nothing short of phenomenal. This remarkable success has to be attributed in some measure to the leadership's policies and decisions of the past three decades.

This economic success is the foundation of those who see China's leadership as brilliant.

But the policies and decisions that worked so well in the boost phase of growth--what we might call the era of low-hanging fruit--do not necessarily work in the next phase, where growth has matured and all the costs that were ignored in the boost phase must now be addressed and paid.

If we look at the problems in China's economy, environment and foreign policy, it seems the leadership is making it up as they go along, with the one overriding goal being to maintain the domestic political control of the Communist Party.

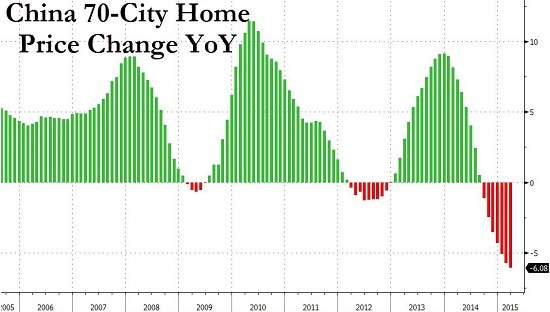

On the economic front, China's leadership has actively pursued policies that expanded the shadow banking system and conventional banking system into a $28 trillion debt bubble. This explosive expansion of credit has fueled a real estate bubble of monumental proportions, and a $10 trillion stock market bubble that is now bursting (as all bubbles eventually do, despite claims that "this time it's different").

Rather than being brilliant, this is a disaster, as bubbles don't dissipate without profound systemic consequences.

rather than deal with the crumbling of the real estate bubble, China's leaders have inflated a stock bubble that promises to bankrupt the tens of millions of households that placed bets in the casino with borrowed money (margin accounts).

On the foreign policy front, China has accomplished the near-impossible, i.e. driving all its neighbors into a united front, as Vietnam, the Philippines, Korea and Japan are all being forced by Chinese belligerence and over-reaching territorial claims to set aside their differences and strengthen ties with the U.S.

Were someone to craft a foreign policy designed to unite all of China's potential enemies into a powerful alliance, this would be the top choice.

The Chinese leadership is acting for all the world as if it moves from strength to strength, when the reality is the opposite: the leadership moves from one catastrophically ill-planned misadventure to the next.

It is easy to predict the unraveling of the real estate and stock market bubbles and the subsequent collapse of China's multi-trillion dollar shadow banking system. Having united all its potential enemies into one camp, China has undone decades of careful diplomacy and boxed itself into a diplomatic corner. Now that it has publicly issued extravagant territorial claims, China cannot back down without losing face; but if it continues to push its claims, it further alienates potential allies and pushes them to strengthen ties with the U.S. and other nations threatened by China's bellicose claims.

In the Great Game, one should never risk one's position before one has the means to defend that position. China is aggressively pursuing territorial claims that is cannot defend without isolating itself--a policy that would doom its export-and-resource dependent economy.

There are few if any historical precedents for China's leaders to follow. the boost phase of plucking low-hanging fruit is the easy part, the fun part, the exciting part.

Dealing with the aftermath of burst credit/asset bubbles, environmental destruction, corruption, wealth inequality, global recession and China's aggressive claim to territory in the South China Sea is the hard part, the not-fun part, the part rife with the potential for catastrophic errors in policy and judgment.

What worked in the post-global financial meltdown era of 2008-2014 (i.e. inflating a $15 trillion credit bubble) will not work the same magic in the next seven years, but there is little evidence that China's leadership (or indeed, the leadership of the U.S. Japan and the European Union) have a Plan B that will replace strategies that are yielding diminishing returns and raising the risks of a systemic failure.

Brilliant or clueless? As Zhou observed, it's too early to tell.

This essay is drawn from Musings Report 27. The Musings Reports are emailed weekly to subscribers ($5/month) and major contributors ($50+/annually).

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Bob Z. ($125), for your outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership.

| |

Thank you, Helen S.C. ($5), for yet another much-appreciated generous contribution to this site -- I am greatly honored by your steadfast support and readership.

|