There are multiple sources of friction in the Perpetual Motion Money Machine.

We've been playing two games to mask insolvency: one is to pay the costs of rampant debt today by borrowing even more from future earnings, and the second is to create wealth out of thin air via asset bubbles.

The two games are connected: asset bubbles require leverage and credit. Prices for homes, stocks, bonds, bat guano futures, etc. can only be pushed to the stratosphere if buyers have access to credit and can borrow to buy more of the bubbling assets.

If credit dries up, asset bubbles pop: no expansion of debt, no asset bubble.

The problem with these games is the debt-asset bubbles don't actually expand the collateral (real-world productive value) supporting all the debt. Collateral can be a physical asset like a house, but it can also be the ability to earn money to service debt.

Credit card debt, student loan debt, corporate debt, sovereign debt--all these loans are backed not by physical assets but by the ability to service the debt: earnings or tax revenues.

If a company earns $1 million annually, what's its stock worth? Whether the market values the company at $1 million or $1 billion, the company's earnings remain the same.

If a government collects $1 trillion in tax revenues, whether it borrows $1 trillion or $100 trillion, the tax revenues remain the same.

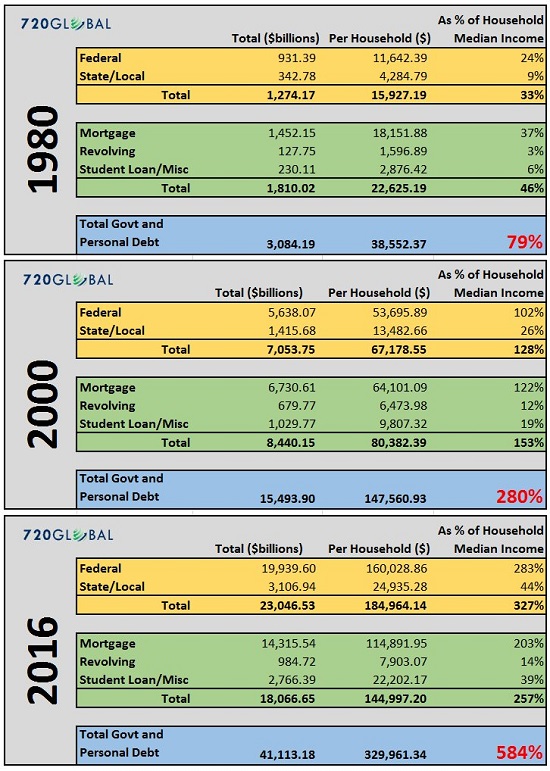

If the collateral supporting the debt doesn't expand with the debt, the borrower's ability to service debt becomes increasingly fragile. Consider a household that earns $100,000 annually. If it has $100,000 in debt to service, that is a 1-to-1 ratio of earnings and debt. What happens to the risk of default if the household borrows $1 million? If earnings remain the same, the risk of default rises, as the household has to devote an enormous percentage of its income to debt service. Any reduction in income will trigger default of the $1 million in debt.

If a household earns $100,000 annually, how much can it borrow? The answer depends on the terms of the debt: the rate of interest and the percentage of principal that must be repaid monthly.

If the interest rate is 0% and the monthly payment is fixed at $1, the household can borrow billions of dollars. This is how the game is played: there is no upper limit on debt if the interest rate is effectively zero, or adjusted for inflation, less than zero.

Would you lend the household your savings, knowing you'll never get any interest and the principal will never be repaid? Of course not. Nobody in a functioning market for capital would throw their hard-earned savings away on a debtor who can't pay any interest or principal.

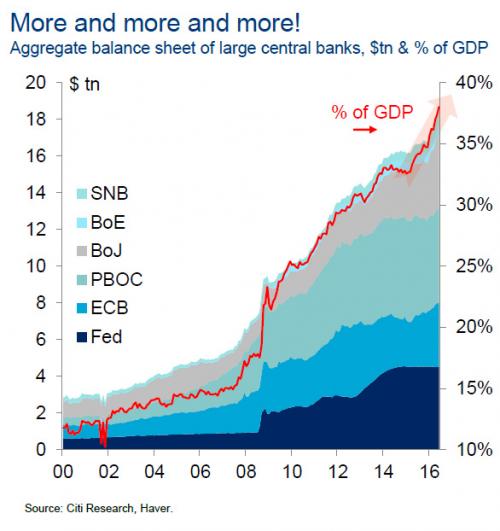

The only institutions that can play this game are central banks, which create money out of thin air at zero cost. As for risk--the way to manage defaults is to print more money.

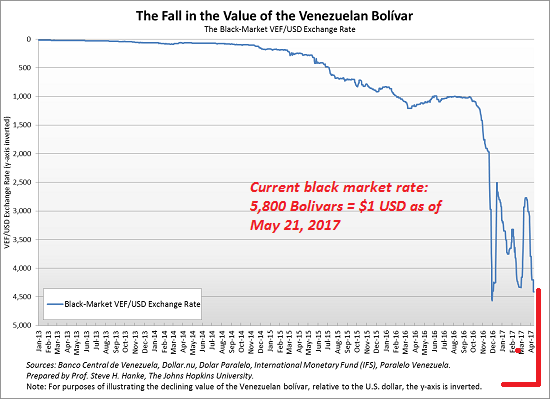

But once again--printing money doesn't create collateral or income needed to service debt. As I have explained, printing money is akin to adding a zero to currency. Every $1 bill is now a $10 bill. Are you ten times wealthier once the central bank adds a zero to every bill? No, because the $5 loaf of bread is re-set to $50.

The other problem with this game is interest keeps ticking higher while earnings remain flat. Even at very low rates of interest, interest payments keep rising. This is not an issue if income rises along with interest payments, but if income is flat, paying higher interest costs eventually pushes the borrower into default.

The household that borrowed $1 billion at 0% paid no interest. But let's say the lender now demands 1/10th of 1% interest--nearly zero interest. The household now owes $1 million in annual interest. Oops! Even near-zero interest can generate crushing interest payments once the debt reaches the stratosphere.

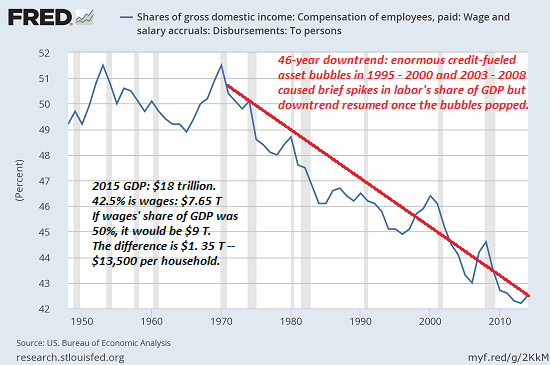

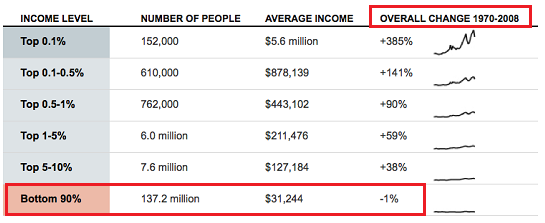

The whole game is a bet that future income will rise faster than debt service.Unfortunately, we've already lost that bet: household income has been stagnant or declining for years (or for the bottom 90%, for decades), and tax revenues have a nasty habit of falling sharply in recessions and stagnating along with private-sector earnings.

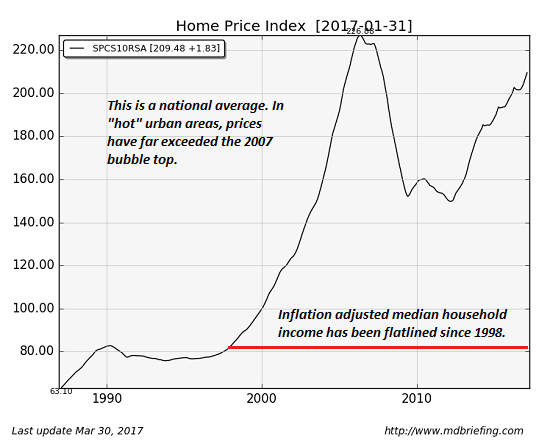

Which leads to the second game: blowing asset bubbles. If the household's earnings are flat or declining, one magical fix is to inflate the household home's value from $100,000 to $300,000 in a few years.

Now the household has $200,000 in new wealth it can tap. Wow, was that easy or what? That's the easiest $200,000 we ever made!

Of course the house didn't actually gain any additional functional or utility value; it still has the same number of rooms, etc. It still only provides shelter for the same number of residents. The $200,000 in "wealth" that can now be borrowed or accessed via selling the house does not reflect an increase in the collateral's utility value--it's all financial magic leveraged off an unchanging utility value and household income.

These games look like a Perpetual Motion Money Machine. There is no cost, it seems, to expanding debt and assets bubbles; if future income doesn't rise enough to service the growing mountain of debt, we either print more money, lower the interest rate or create "wealth" with even grander asset bubbles.

But there is eventually a problem. At some point, even 0.1% interest becomes unaffordable, and adding zeroes to the currency devalues the currency faster than incomes rise. Asset bubbles run out of greater fools to buy at elevated prices.

Borrowers default, asset prices crash and everyone holding the currency is impoverished.

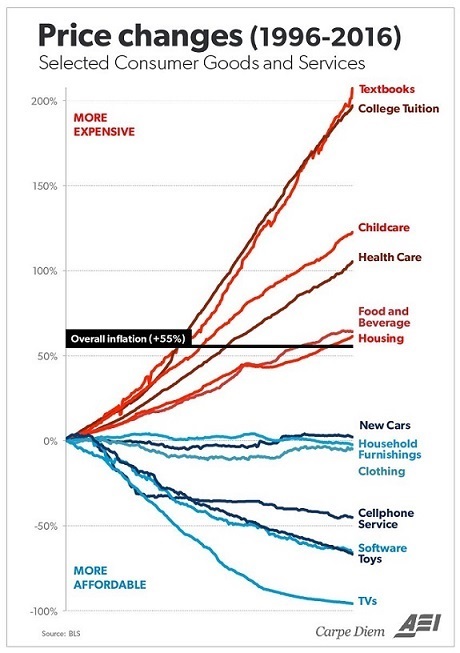

There are multiple sources of friction in the Perpetual Motion Money Machine.State-cartel inflation eats away at stagnating incomes, rising interest payments eat away at stagnant incomes and tax revenues, and printing money eats away at the purchasing power of the currency. Eventually these sources of friction cause the Perpetual Motion Money Machine to grind to a halt and then shatter.

Put another way, the debt-asset bubble supernova consumes all the available fuel and implodes. I've employed the supernova analogy for many years, as it captures the expansion of debt and asset valuations and the resulting collapse once all the fuel in the system (i.e. earnings and real collateral) has been consumed.

State-protected cartels jack up prices with abandon, slashing disposable incomes. Get rid of competition and enforce a monopoly, and this is what you get:

Real earnings for the bottom 90% have gone nowhere but down for decades:borrowing from the future doesn't work if future earnings are lower.

While incomes stagnated, housing has ballooned into Real Estate Bubble #2.

Central banks have printed currency with abandon. Everybody loves free money--especially bankers and financiers.

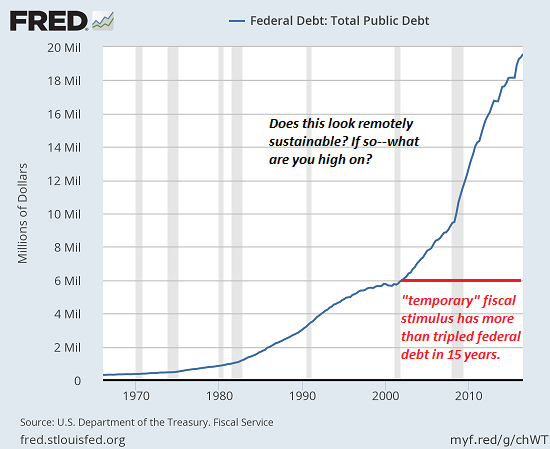

Federal debt has tripled--no problem, let's triple it again, and then triple that.There is no upper limit on how much the Empire can borrow, right? "We are the ultimate power in the Universe now," etc.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Darren B. ($200), for your beyond-outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership.

| |

Thank you, G. Wayne A. ($15), for your much-appreciated generous contribution to this site -- I am greatly honored by your steadfast support and readership.

|

Read more...